In our business Twitter and Facebook are simply a must engagement tool. Digital PR to our Travel News segment, any company that does business online simply has to make us of and communicate via social media. This 'almost' goes without saying now. I say 'almost' because there still are companies out there resistant (hard headed) enough to believe digital communication is a trend.

Lennar Top Twitter Feed of September

At the other end of the spectrum, there are the movers and shakers in every realm working the social media airwaves. Below you will find this month's real estate elite on Twitter, along with a brief synopsis of what they do and do not do right.

MSN Real Estate - Microsoft's real estate social media component really needs no intro. As for what they do right, 40,000 followers and a post an hour says a lot about being serious. On the other hand a blurry avatar and not following so many (171) shows some lack of caring and real engagement.

MSN Real Estate - Microsoft's real estate social media component really needs no intro. As for what they do right, 40,000 followers and a post an hour says a lot about being serious. On the other hand a blurry avatar and not following so many (171) shows some lack of caring and real engagement.

WSJ Real Estate - 71,800 followers and an avatar that is not blurry show the WSJ is in the running for the most influential Twitter feed among real estate feeds. Following almost nobody may also be a sign we should all 'unfollow' them too. They don't exactly burn up the two way conversation with tweets either.

WSJ Real Estate - 71,800 followers and an avatar that is not blurry show the WSJ is in the running for the most influential Twitter feed among real estate feeds. Following almost nobody may also be a sign we should all 'unfollow' them too. They don't exactly burn up the two way conversation with tweets either.

O'Neill Real Estate - Isn't it nice to see a smiling face in the top ten real estate peeps on Twitter? Toronto's George O'Neill is actually a lot more 'engaged' than the aforementioned news gurus up there. With 20 something thousand followers and following a couple thousand peeps, O'Neill also tweets very often, and not just his own stuff. Not a lot wrong here.

O'Neill Real Estate - Isn't it nice to see a smiling face in the top ten real estate peeps on Twitter? Toronto's George O'Neill is actually a lot more 'engaged' than the aforementioned news gurus up there. With 20 something thousand followers and following a couple thousand peeps, O'Neill also tweets very often, and not just his own stuff. Not a lot wrong here.

Real Estate Pro - Oliver Graf had the good sense to snatch a great Twitter vanity label, didn't he? Near 20,000 followers, frequent tweets, the guy (or his admin) knows his stuff pretty well. Following near nobody and broadcasting his own wares too much does tend to make the passerby wonder if the agent is a narcissist or not? Get a better avatar too Oliver.

Real Estate Pro - Oliver Graf had the good sense to snatch a great Twitter vanity label, didn't he? Near 20,000 followers, frequent tweets, the guy (or his admin) knows his stuff pretty well. Following near nobody and broadcasting his own wares too much does tend to make the passerby wonder if the agent is a narcissist or not? Get a better avatar too Oliver.

Real Estate Tweeter - Just how or what 2M is? 45,000 followers and speaking with over 3 thousand feeds, this user reveals news, news, and news about the industry. Okay, 2M are real estate advisers out of Houston. They get the nod for all they do good, and a Cheshire grin for the ugly avatar.

Real Estate Tweeter - Just how or what 2M is? 45,000 followers and speaking with over 3 thousand feeds, this user reveals news, news, and news about the industry. Okay, 2M are real estate advisers out of Houston. They get the nod for all they do good, and a Cheshire grin for the ugly avatar.

NYT Real Estate - What do you expect? It's the New York Times after all. I can remember when the NYT was resistant to the whole concept of Web 2.0, engaging online, wanting peeps to pay, pay, pay for online subscriptions, blah blah. Their real estate Twitter feed has a herd of followers, some 60 something grand ' but Oppps! Apparently the world's most famous newspaper is too proud to follow anybody but their own reporters and their own journalistic kind. Sad. I decided not to follow them either, but the avatar is very nice.

NYT Real Estate - What do you expect? It's the New York Times after all. I can remember when the NYT was resistant to the whole concept of Web 2.0, engaging online, wanting peeps to pay, pay, pay for online subscriptions, blah blah. Their real estate Twitter feed has a herd of followers, some 60 something grand ' but Oppps! Apparently the world's most famous newspaper is too proud to follow anybody but their own reporters and their own journalistic kind. Sad. I decided not to follow them either, but the avatar is very nice.

Real Estate HQ ' - The name says a lot. 37,000 plus followers, following almost 8500, tweets frequently, and actually @ other people! If not for their ugly stock image avatar, these guys could be the best real estate Twitter gurus in real estate. I followed them, and tweeted for them to change that stupid avatar there.

Real Estate HQ ' - The name says a lot. 37,000 plus followers, following almost 8500, tweets frequently, and actually @ other people! If not for their ugly stock image avatar, these guys could be the best real estate Twitter gurus in real estate. I followed them, and tweeted for them to change that stupid avatar there.

Real Estate Global - Ugly. I cannot get past ugly, Web 1.0 marketer avatars and websites. Despite this feeds obvious real engagement (they really do know their stuff), 40,000 followers and 20, 000 followed is a perfect ration to indicate a Twitter user is on the job. Tweeting in a broadcasting fashion? Well, Real Estate Global is not first on this list, are they?

Real Estate Global - Ugly. I cannot get past ugly, Web 1.0 marketer avatars and websites. Despite this feeds obvious real engagement (they really do know their stuff), 40,000 followers and 20, 000 followed is a perfect ration to indicate a Twitter user is on the job. Tweeting in a broadcasting fashion? Well, Real Estate Global is not first on this list, are they?

Real Estate Marketer ' - Anybody that uses the word marketer in the name' 30 something thousand following and following nobody, this feed should probably not be in this list, but' Twitter listed em, not me. At least their avatar is a cute little blue Monopoly house. I didn't follow these guys for obvious reasons.

Real Estate Marketer ' - Anybody that uses the word marketer in the name' 30 something thousand following and following nobody, this feed should probably not be in this list, but' Twitter listed em, not me. At least their avatar is a cute little blue Monopoly house. I didn't follow these guys for obvious reasons.

Real Estate Law - I am sitting here thinking about the old 'lawyer joke' about attorneys chained together at the bottom of the sea. I wonder if their is a way to chain lawyers together at the bottom of Twitter? Oh, in this case it would not be fair anyway. The feed connected to some of the world's leading realty attorneys is actaully one of the best on Twitter, which I find interesting because lawyers generally have zero time. Value and relevance wise, Real Estate Law offers up very useful stuff for agents and homeowners too. Like; 'Real Estate: Argument Report: When Can a Foreclosure Be Appealed?' A tweet that just may help somebody. Fix the avatar guys.

Real Estate Law - I am sitting here thinking about the old 'lawyer joke' about attorneys chained together at the bottom of the sea. I wonder if their is a way to chain lawyers together at the bottom of Twitter? Oh, in this case it would not be fair anyway. The feed connected to some of the world's leading realty attorneys is actaully one of the best on Twitter, which I find interesting because lawyers generally have zero time. Value and relevance wise, Real Estate Law offers up very useful stuff for agents and homeowners too. Like; 'Real Estate: Argument Report: When Can a Foreclosure Be Appealed?' A tweet that just may help somebody. Fix the avatar guys.

The Real Estate Book - Another broadcasting feed, with what appear to be a good number of 'bought' followers, this real estate entity does engage with frequent tweets to many thousands. We won't be following them, but you may find some of their tweets useful. The feed links to a mediocre cookie cutter listing/agent search site.

The Real Estate Book - Another broadcasting feed, with what appear to be a good number of 'bought' followers, this real estate entity does engage with frequent tweets to many thousands. We won't be following them, but you may find some of their tweets useful. The feed links to a mediocre cookie cutter listing/agent search site.

LA Times Real Estate - Again, a major news contingent that broadcasts to many thousands. That's all that can be said for or against such Twitter engagements really. To be honest, the LA Times never really impressed me much in any regard. Of all the newspapers I ever reached out to, LA Times is at the top of a long list of publications that are content to not give the time of day. Sorry, my feeling. The feed here kind of reflects this too. I put em here cuz Twitter shows em tops and because they do reflect good content about So Cal homes. (maybe that is good enough?)

LA Times Real Estate - Again, a major news contingent that broadcasts to many thousands. That's all that can be said for or against such Twitter engagements really. To be honest, the LA Times never really impressed me much in any regard. Of all the newspapers I ever reached out to, LA Times is at the top of a long list of publications that are content to not give the time of day. Sorry, my feeling. The feed here kind of reflects this too. I put em here cuz Twitter shows em tops and because they do reflect good content about So Cal homes. (maybe that is good enough?)

Zillow - These guys should really be tops on Twitter. There, I said it. Not a fan of corporate Expedia-type online services myself, Zillow does offer a lot of value for users. Their Twitter is proportionalely useful too. No big broadcasters, frequent as any, and with 70 something gran in followers, maybe I should have put them up there? Well, they did start their name with a Z, after all. I followed em.

Zillow - These guys should really be tops on Twitter. There, I said it. Not a fan of corporate Expedia-type online services myself, Zillow does offer a lot of value for users. Their Twitter is proportionalely useful too. No big broadcasters, frequent as any, and with 70 something gran in followers, maybe I should have put them up there? Well, they did start their name with a Z, after all. I followed em.

Chicago Real Estate - Somebody needs to explain Twitter to Newman Realty. Maybe even the Internet as a whole? Besides the nice brown color, and the passable logo over there, this Illinois agency seems to be going through the motions on Twitter and via their website. But then, Scott Newman's site is new, maybe I should cut them some slack? Nah! The top tweet goes full Brian Solis narcissist; 'My radio debut! http://lnkd.in/v2wHn7'

Chicago Real Estate - Somebody needs to explain Twitter to Newman Realty. Maybe even the Internet as a whole? Besides the nice brown color, and the passable logo over there, this Illinois agency seems to be going through the motions on Twitter and via their website. But then, Scott Newman's site is new, maybe I should cut them some slack? Nah! The top tweet goes full Brian Solis narcissist; 'My radio debut! http://lnkd.in/v2wHn7'

Real Estate FSBO - Huh? This feed's last tweet was in 2009. Is this a foreclosed upon Twitter feed? It happens once in a while, a nice outfit hooks up in social media and then the passion and enthusiasm falls by the wayside. The link to the website goes to two happy faces in the middle of the word 'soon' so' How did six thousand peeps follow them?

Real Estate FSBO - Huh? This feed's last tweet was in 2009. Is this a foreclosed upon Twitter feed? It happens once in a while, a nice outfit hooks up in social media and then the passion and enthusiasm falls by the wayside. The link to the website goes to two happy faces in the middle of the word 'soon' so' How did six thousand peeps follow them?

Real Estate Board NY - One of the world's most famous real estate boards has their foot in the social media door with this feed. Broadcasting useful NY industry news, not many will be enamored with anything here. There are 13,000 followers, but I do not live in NY. Talk to real people more guys.

Real Estate Board NY - One of the world's most famous real estate boards has their foot in the social media door with this feed. Broadcasting useful NY industry news, not many will be enamored with anything here. There are 13,000 followers, but I do not live in NY. Talk to real people more guys.

ET Real Estate - The Economic Times' feed is yet another example of a big media outlet 'telling' followers all about what's important to ET. I always wondered why fans follow around behind rock stars, but financial newspaper back doors? This one needs some attention badly.

ET Real Estate - The Economic Times' feed is yet another example of a big media outlet 'telling' followers all about what's important to ET. I always wondered why fans follow around behind rock stars, but financial newspaper back doors? This one needs some attention badly.

Real Estate Center ' - The Real Estate Center at Texas A&M University, one would think, could get some students to maintain their Twitter feed properly. Not caring to follow too many, even frequent posts all about self interest to six thousand is' lacking. At least the link to TAMU takes followers to A&M's nice website. I ain't following tho.

Real Estate Center ' - The Real Estate Center at Texas A&M University, one would think, could get some students to maintain their Twitter feed properly. Not caring to follow too many, even frequent posts all about self interest to six thousand is' lacking. At least the link to TAMU takes followers to A&M's nice website. I ain't following tho.

Real Estate, band - You guessed it, this feed has nothing to do with real estate. The band feed and their site does however, do a better job of social media engagement than 90 percent of Realtors. Tongue in cheek aside, I left this one in to illustrate just that point. I guess we can all look at these feeds and determine that real estate as a whole may need to ramp things up digitally. But then, I have been preaching that for a while now.

Real Estate, band - You guessed it, this feed has nothing to do with real estate. The band feed and their site does however, do a better job of social media engagement than 90 percent of Realtors. Tongue in cheek aside, I left this one in to illustrate just that point. I guess we can all look at these feeds and determine that real estate as a whole may need to ramp things up digitally. But then, I have been preaching that for a while now.

Real Estate Agent - Ditto everything bad for this feed. The last tweet was in June, they follow absolutely one person, and all in all it looks like a place holder for some coming feed. Almost 4 thousand followed already? Not us tho.

Real Estate Agent - Ditto everything bad for this feed. The last tweet was in June, they follow absolutely one person, and all in all it looks like a place holder for some coming feed. Almost 4 thousand followed already? Not us tho.

Tampa Real Estate ' - I like these guys. 59 minutes ago they tweeted to six thousand plus, a classy Twitter that follows about 1500, Tampa has always been a real estate haven. I cannot say much for the blog and the website behind the feed however, but not one of these Tweeters is perfect. Given that Twitter and Facebook may become more valuable than a good landing page' You get the message, at least Tampa Real Estate is a voice, or is that a tweet?

Tampa Real Estate ' - I like these guys. 59 minutes ago they tweeted to six thousand plus, a classy Twitter that follows about 1500, Tampa has always been a real estate haven. I cannot say much for the blog and the website behind the feed however, but not one of these Tweeters is perfect. Given that Twitter and Facebook may become more valuable than a good landing page' You get the message, at least Tampa Real Estate is a voice, or is that a tweet?

Calgary Real Estate - Jim Sparrow likes to water ski, and tweet. A ratio of near 7000 followed to 17000 followers is pretty good as far as that goes, but Sparrow also tweets important info frequently. Just what skiing has to do with buying homes there (we ain't talking snow here), I am not sure. The agent does have a very nice site linked to this feed too. I followed him.

Calgary Real Estate - Jim Sparrow likes to water ski, and tweet. A ratio of near 7000 followed to 17000 followers is pretty good as far as that goes, but Sparrow also tweets important info frequently. Just what skiing has to do with buying homes there (we ain't talking snow here), I am not sure. The agent does have a very nice site linked to this feed too. I followed him.

Lennar - This feed should be a candidate for 'best' where Twitter social impact goes. Hundred something thousand followers and following, all relevant tweets, and even the name of the social media director. Transparent and putting real people where interested passers by and followers are' Nice. I followed. Rated Best

Lennar - This feed should be a candidate for 'best' where Twitter social impact goes. Hundred something thousand followers and following, all relevant tweets, and even the name of the social media director. Transparent and putting real people where interested passers by and followers are' Nice. I followed. Rated Best

AOL Real Estate - AOL Real Estate has a Klout score even higher than mine. 64 means the guys engage at a pretty high level, and behind the Twitter feed you'll find customary AOL looks. I must say I was skeptical AOL would have any sort of decent feed, but they do. Usually, anything associated with the once dominant brand gets watered down and turned mediocre. Not so here.

AOL Real Estate - AOL Real Estate has a Klout score even higher than mine. 64 means the guys engage at a pretty high level, and behind the Twitter feed you'll find customary AOL looks. I must say I was skeptical AOL would have any sort of decent feed, but they do. Usually, anything associated with the once dominant brand gets watered down and turned mediocre. Not so here.

REALTOR.com - The flip side of expectations from AOL above, the best domain name in the industry offers up about as mediocre a feed as is imaginable. A blurry avatar and twelve thousand followers for a brand that should have 200,000? Sorry, I am disappointed. These people actually have money, I do my digital footprint across 20 domains with my salary. Give me a break guys. Put up a nice logo there and get your admin to follow some peeps. Rated Biggest Disappointment

REALTOR.com - The flip side of expectations from AOL above, the best domain name in the industry offers up about as mediocre a feed as is imaginable. A blurry avatar and twelve thousand followers for a brand that should have 200,000? Sorry, I am disappointed. These people actually have money, I do my digital footprint across 20 domains with my salary. Give me a break guys. Put up a nice logo there and get your admin to follow some peeps. Rated Biggest Disappointment

A lot can be read in between the lines of what I call brand symbolism. We do, a lot of our clients do, inestimable work load with so limited resource. My motto for online engagement has always been, 'if you can do it right, just don't do it.' True, not many have the resources to do perfect branding across their network, but outfits like these massive news media contingents and real estate 'go to' people? Realtor up there should take that feed down until it can be properly branded with graphics ' it sets a horrible example. As for the others? Some like Tampa and Lennar up there, they really have it going on.

Let us know if we missed anybody here for a top 25 list. We actually do enjoy giving notice to great digital engagement.

Considered one of the leaders in the revival of the property market in the United States, Miami has just witnessed a significant increase in home prices again in August, according to new data from Miami Association of Realtors.

Considered one of the leaders in the revival of the property market in the United States, Miami has just witnessed a significant increase in home prices again in August, according to new data from Miami Association of Realtors.

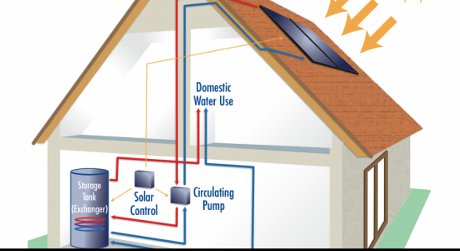

Promise Energy may be the harbinger of new age solar water heating in California. The company offering of solar energy service agreements that ensure that both state and federal tax credits are maximized is not only a novel approach to savings, but a near perfect conduit to solar affordability. The company announced that it will initiate the program at the annual Southern California Association of Non-Profit Housing (SCANPH) conference, happening in LA on September 28th.

Promise Energy may be the harbinger of new age solar water heating in California. The company offering of solar energy service agreements that ensure that both state and federal tax credits are maximized is not only a novel approach to savings, but a near perfect conduit to solar affordability. The company announced that it will initiate the program at the annual Southern California Association of Non-Profit Housing (SCANPH) conference, happening in LA on September 28th.