One of the key features that homeowners look to increase in their home is privacy. When at home it's important to feel as though you can fully unwind and by yourself, and that can be difficult when you've got a nosy neighbor with a bird's eye view of your outdoor entertaining areas.

© Sea Wave ' Fotolia.com

For those looking for an alternative to the expense of constructing a privacy fence, consider using shrubbery to create a natural barrier.

Before you spring for a landscaper and some expensive foliage there are a few things to consider, however. First you'll want to think about what height and width you'd like for your barrier plants to be. For instance if you live in close quarters with your neighbours and some of them have elevated decks that overlook your backyard you'll probably want some shrubbery that grows to be high enough to eliminate their view.

Second, consider what grows best in your climate. If you're using a professional landscaper to help you install the shrubbery they're sure to know what types of foliage do best in your climate and provide the best cover year round. If you live in a climate that allows for outdoor entertaining year round it would be best if you didn't choose a tree or shrub that loses most of it's foliage during the winter. On that note, if you'll only be utilizing your outdoor spaces (and therefore need your privacy) during specific seasons of the year you might choose some more aromatic or aesthetically pleasing shrubbery to add some décor to your outdoor space.

Finally you'll want to consider how much maintenance you want to put into your shrubs. Some bushes might require more pruning than others not only to help them grow but throughout their lives. If you're not looking to drastically increase your lawn workload you may want to choose shrubbery that requires little or no maintenance in order to thrive.

Naturally the best way to make these decisions would probably to consult with a professional landscaper. Any landscaper worth their salt should have a working knowledge of which plants will work best for your specific criteria. They'll also be able to handle planting the shrubbery in the appropriate distance from one another and in instances where you'll be installing more mature bushes they have the equipment and man power for the installation which you as a homeowner might lack. If you'd like to go it alone, however, check out the useful articles here and here. Both contain a wealth of information regarding choosing and planting shrubbery for privacy purposes.

Using shrubbery to create a natural privacy barrier on your property is not only cheaper than installing a more traditional privacy fence or wall, it's better for the environment and more aesthetically pleasing. By choosing the right shrubbery for your needs you can enjoy increased privacy from your neighbors with little maintenance and minimal financial investment.

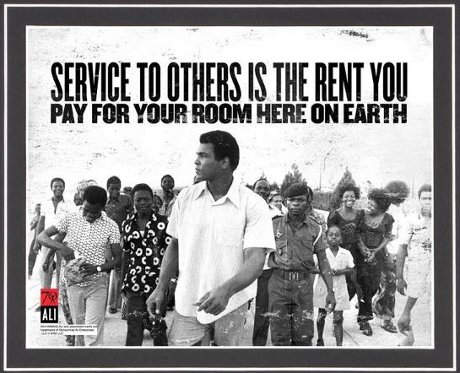

We've all read or heard about the selfless acts of others; like Mother Teresa who founded the Missionaries of Charity and spent 45 years of her life ministering to the poor, sick, orphaned, and dying in Kolkata's slums. Most of us have heard tales of sacrifice too; such as the incredible story of the Mexican railroad engineer Jesús García Corona, who bravely drove a burning train loaded with dynamite away from the village of Nacozari de García, killing himself but saving the lives of everyone else.

We've all read or heard about the selfless acts of others; like Mother Teresa who founded the Missionaries of Charity and spent 45 years of her life ministering to the poor, sick, orphaned, and dying in Kolkata's slums. Most of us have heard tales of sacrifice too; such as the incredible story of the Mexican railroad engineer Jesús García Corona, who bravely drove a burning train loaded with dynamite away from the village of Nacozari de García, killing himself but saving the lives of everyone else.