Let's face it, even in bright economic times business is just plain cutthroat anyhow. Still, learning of shady deals by real estate agents is not exactly good news for sellers, buyers, or their intermediaries. As news people we have a duty to report, but it pains us a bit to make the following report. With 75 percent or more of buyers looking online and via mobile before buying, the digital revolution is a double edge sword that will severely cut the unethical. You had better read this.

'Bait and switch', 'double ending', out and out lies, these are terms that essentially destroy consumer confidence in the professional real estate broker. But these and more happen every day, and apparently often. This article in Mail Online tells it like it is for real estate, an industry that has way more agents than contracts at the moment. That revealing article leads to still another resource, ABC's 20/20 where everyone interested can learn of the so called '7 Inside Secrets of Real Estate Agents', oh boy. Just what every real estate professional needs right now, more horror stories.

If the real estate business has become some sort of primeval and deadly game for survival, how in the world can a buyer or seller trust that their hard earned trust is not betrayed somehow? The simple answer in most cases is, they can't Looking at such shady maneuvers as 'double ending', one has to realize just how crucial trust and credibility really are. Hiding a higher offer, so an agent can get ALL the commission from a sale? There should be jail time in there somewhere. We have to redefine what professionalism in real estate is:

''the conduct, aims, or qualities that characterize or mark aprofession or a professional person''

Before I go on, let me list the most common tricky real estate moves:

- Agent Doublespeak: This is basically false advertising by using misleading keywords to sell, words like cute, quant, and etc. to minimize the impact of what amounts to a tiny space. Not exactly illegal, you can see that 'smoothing over' some characteristics can actually be quite deceiving.

- Bait-and-switch: Agents put up fake listings, or either leave old listing up long after they've been sold. When clients ask about 'fake' listings, they are simply directed to other 'real' inventory.

- Shameless Self Promotion: This speaks of the ever popular 'Open House' ' a sideshow to basically brand an agent or agency

- Silence: Sometimes the biggest lies unspoken. Imagine an agent walking on top of floor joists being munched by termites.

- The Deadly Double End: As mentioned, concealing a higher offer in order to cut another agent out of the commission.

Not unlike the car business, or any sales oriented business for that matter, real estate us ever more subjected to the pressure of economics. In short, ethics tend to migrate South the more or less money is involved. Even still, we as consumers are right to expect the term 'professional' to see us into the clear. Fact is, it just does not happen in many cases. As top NY agent Ryan Serhant suggests in the ABC article by Jim Dubreuil:

'In New York City alone, there are 27,000 real estate agents,' he continued. 'Last year there were 12,598 contracts, right? That means a lot of real estate agents did not do deals.'

And there's your Darwinian struggle, as Dubreuil puts it. The Mail Online's Snejana Faberov goes a bit deeper to study a bit just how consumers have to hone their own skills in order not to be duped by unethical agents. What's more alarming, and in the end damaging here is the fact unethical dealing is not exactly dependent on a distressed economy, the problem is much more epidemic than that.

And there's your Darwinian struggle, as Dubreuil puts it. The Mail Online's Snejana Faberov goes a bit deeper to study a bit just how consumers have to hone their own skills in order not to be duped by unethical agents. What's more alarming, and in the end damaging here is the fact unethical dealing is not exactly dependent on a distressed economy, the problem is much more epidemic than that.

An article at SF Gate back in 2001 tells of exactly the same choleric profession back then. While a great many real estate professionals do adhere to the ethical standards set forth by organizations such as the National Association of Realtors, the lack of teeth these organizations show predicates non-adherence for many.

Being unprofessional has been around as long as there have been professions, so all this is nothing new. The problem now is the added pressure of massive foreclosures, rampant speculation, mistrust of banks and other institutions, and business' reputation in general. At stake? Nothing less than the reputation or even survival of the profession as a whole. That's right, there is a world in which buyers and sellers will not even need a real estate broker, it's called FSBO. But that's a nasty word to use on a real estate news site.

Take a look at this. Even the NAR can meet out misleading numbers. In this report it looks like FSBO sales garner far less than agent assisted sales. The 'teaser' report that leads to the expensive one makes things look like those idiotic home owners who choose to sell their own property, they look like they just can't cut it. I quote:

'FSBOs accounted for 10% of home sales in 2011. The typical FSBO home sold for $150,000 compared to $215,000 for agent-assisted home sales''.'

Now for $150, as an agent, you can buy the entire 2011 NAR Profile of Home Buyers and Sellers  . or if you want to learn how to leverage social media, you can even buy Facebook Marketing For Dummies

. or if you want to learn how to leverage social media, you can even buy Facebook Marketing For Dummies (There, for $1o from Amazon with free shipping) from NAR for only $24.99, or over twice what the book costs at Amazon. Of course there are NAR member prices and deals on NAR specials like the 'Social Media for REALTORS® Series VIP 4 Pack' for only $42.95 for non-members. Uh hum.

(There, for $1o from Amazon with free shipping) from NAR for only $24.99, or over twice what the book costs at Amazon. Of course there are NAR member prices and deals on NAR specials like the 'Social Media for REALTORS® Series VIP 4 Pack' for only $42.95 for non-members. Uh hum.

My point here should be clear. The NAR is the most trusted organization associated with the profession in America. If I perceive of some carnival sales atmosphere going on, whether it was intended or not' You see the rub, I hope. There's room for lots of improvement wherever you look. Taking NAR's facts and figures on FSBO as a benchmark of a kind, this information is disseminated across a wide swath of the real estate landscape, I hope you realize. Good, bad, or indifferent where facts are concerned, any idea conveyed with so powerful a force needs scrutiny. That's the complicated way of saying; 'Hey, lots of people are believing and using this data, how accurate is it?'

Anyone with half a mind has to be asking; 'How valid are numbers based solely on a vested interest's say so?' NAR says one thing, such entities as Flat Fee MLS and a massive subset of factors are not revealed, and somehow we understand that only 10 percent of sales are via individuals? I am not saying NAR is trying to mislead exactly, but others may read things that way. Where it the transparency in a $150 dollar report? This is one good question. And, if half the homes in Quebec or other parts of Canada can be sold saving the owners commissions, then why not in the US?

Off NAR for now, just trusting the wrong agent can lose a seller or a buyer a lot more than a 6% commission. That's right, factor in 'double ending' for an instance. You really get an offer of say, $250,000 for that chic condo you want to unload. The agent is going to have to split $15,000 bucks with another agent, so that offer 'goes away' to be replaced by one for $235,000 say. The seller loses 15 grand, the broker makes $6600 more. Tell me this never happens. Enter the RICS.

Now I'm not pitting the Royal Institute of Chartered Surveyors against the NAR. Well, okay I am, and since I am it should be noted here that in the UK one of the least trusted professions is the person we call a broker. Maybe if we told the truth, American brokers have just largely slipped the bonds of being no better than used car salespersons. Whatever the case I can find free in depth data on just about anything at RICS. Take this report about the so called 'Pop Up Movement' ' the PDF you read here is indicative.

Let me end this part of an ethics discussion by showing how RICS as a so called 'self governing body' deals with the issue of standards and ethics. First of all, there is no end to the informational effort made by this body in attempting to quantify and qualify the ethics or professional behavior. Take a look at this 'free' resource for professionals so concerned. The decision making chart creates a sort of 'dummy's guide' to professional action here. Whether or not anyone makes use of such things as the RICS Ethics Training Modules or not, the professional nature and value exhibited are still there.

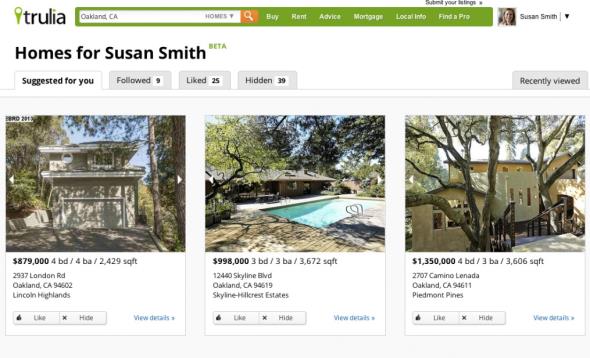

Another piece of the sales pie ' your home listed among millions

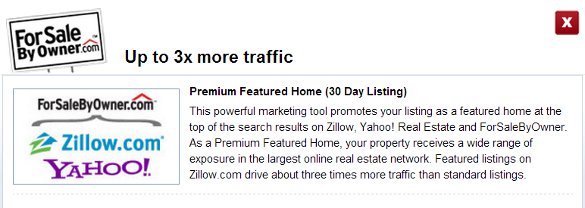

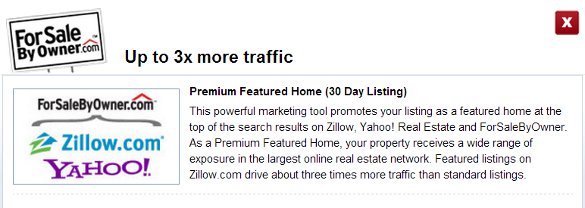

Last, but certainly not least along this 'ethics trail' we're on. Even venturing over toe FSBO.com we find just about anything and everything for sale that can actually be had for free elsewhere. In the case of this link? Figuring out how much your home is worth, that's what you get for the low, low price of $40. Then, looking at what FSBO sells by way of visibility, marketing, and listing, it looks like everybody from Zillow to Yahoo! and Realtor.com gets a piece of your $699 plus bucks. Is it just me or does this feel like 1995? Well here's the biggest problem for people who get commissions for their services. The listing below with the dark pictures and no image of the beach at Isle of Palms, SC ' this is what FSBO means by putting your listing in front of 2 million visitors a month. Dependent on your own marketing capability, you can guess how many people saw this.

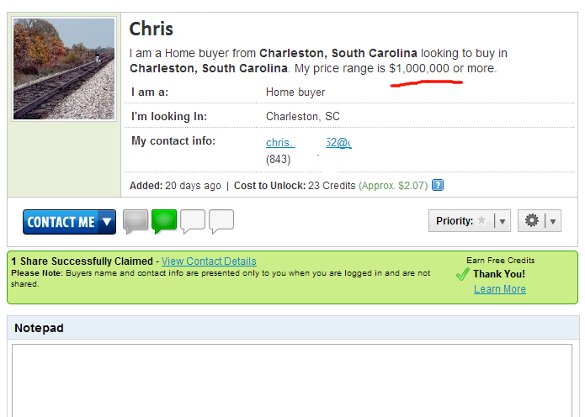

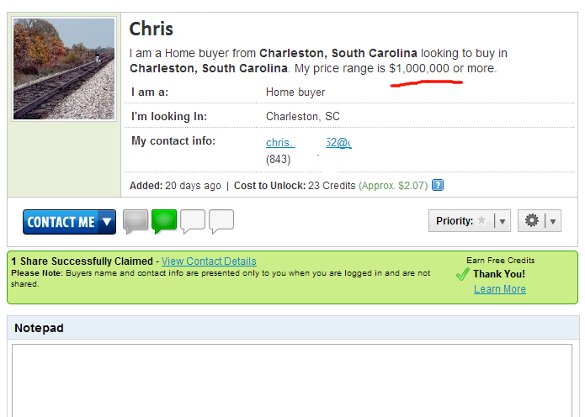

The digital revolution is not just capable of transforming your real estate business, it's also capable of destroying it. The image you see below is from one of our advertisers, Qazzoo. You see the essences of sales in any form boils down to getting buyers. Trust, mistrust, all of our rhetoric takes us to the undeniable fact home sales are all about leads. So, if technology like a 'consumer search engine' can put buyers with sellers effectively. As you can see if the 'guaranteed lead' supplied by Qazzoo for a couple of bucks here comes through, this homeowner just saved $45,000 dollars minus $2.07 for the Qazzoo lead. I guess you could factor out the cost of the phone call or email too.

Are you with me now on ethics?

A lead purchased using Qazzoo for an Isle of Palms property. Name and info hidden

Other image credits: Good versus evil agent ' courtesy © DigitalGenetics ' Fotolia.com

Summit Industrial Income REIT has just announced their acquisition of 15 industrial properties in the greater Toronto, Moncton, New Brunswick; and Edmonton, Alberta areas. The REIT adds some 2 million square feet of leasable space to their Summit II portfolio.

Summit Industrial Income REIT has just announced their acquisition of 15 industrial properties in the greater Toronto, Moncton, New Brunswick; and Edmonton, Alberta areas. The REIT adds some 2 million square feet of leasable space to their Summit II portfolio.

And there's your Darwinian struggle, as Dubreuil puts it. The Mail Online's Snejana Faberov goes a bit deeper to study a bit just how consumers have to hone their own skills in order not to be duped by unethical agents. What's more alarming, and in the end damaging here is the fact unethical dealing is not exactly dependent on a distressed economy, the problem is much more epidemic than that.

And there's your Darwinian struggle, as Dubreuil puts it. The Mail Online's Snejana Faberov goes a bit deeper to study a bit just how consumers have to hone their own skills in order not to be duped by unethical agents. What's more alarming, and in the end damaging here is the fact unethical dealing is not exactly dependent on a distressed economy, the problem is much more epidemic than that.

In other news about Quadrant Estates, Property Week has reported Kohlberg Kravis Roberts (KKR) and Quadrant Estates discussing buying a portfolio of retail parks in Sunderland, Glasgow, and Oxford. The value of the proposed deal is suggested at £115 million for the portfolio.

In other news about Quadrant Estates, Property Week has reported Kohlberg Kravis Roberts (KKR) and Quadrant Estates discussing buying a portfolio of retail parks in Sunderland, Glasgow, and Oxford. The value of the proposed deal is suggested at £115 million for the portfolio.