This morning I thought I should touch on a subject everyone reading RealtyBizNews might identify with ' SPAM. In an effort to save electricity and life force too, the following report on the so called Fendi Casa in the Sky, and Hundred Stories PR which represents developments in NY, is a cautionary tale, as you shall see.

The Setai in New York City ' courtesy hotel Facebook

First the good news. Even though I have requested to be removed multiple times from Hundred Stories PR's mailing list, I received yet another invitation to attend an event in New York City at the Residences at 400 Fifth Avenue's Fendi Casa penthouse shindig. The first Fendi Casa show home located at the prestigious 400 Fifth Avenue address, it only seems appropriate that the parties of the first par throw a gala to announce the most luxurious (so far) high fashion high rise affair.

A bathroom view from 400 Fifth ' Courtesy their website

Another offering from the Residences at 400 Fifth Avenue (one view above), there's little doubt this latest luxury living wonder will be just that, as I am sure last evening's celebration sponsored by Luxury Living, Douglas Elleman Development Marketing, and Bizzi & Partners was. Situated two blocks from the world famous Empire State Building, 400 Fifth Avenue is a spectacular address. But, while sharing 'Manhattan views, hors d'oeuvres and cocktails' with the developers would have been wonderful, there is a blotch ' a big PR one.

For a couple or three years now Hundred Stories PR has emailed me at both my personal and corporate addresses, and from just about every conceivable real estate angle you can think of. But one, two, or even three account execs hitting me up in one day is not so problematic, that is until. On multiple occasions, and by 'multiple' I mean more than three, I have asked Hundred Stories PR to remove both my accounts from their mailing lists. There are multiple reasons why I asked, not the least of which is I feel most of the PR agency's announcements are useless. Of course that is my opinion only. SPAMMING contemporaries, or anyone for the matter, is just plain bad relations ' I know, we run an online PR agency.

View of the Setai from the Empire State Building . courtesy their Facebook

Okay, I know you are thinking 'big deal', some Manhattan PR flakes SPAM a blogger, slash news guy, slash tech geek, slash whoever. That's not the point, arrogance and indifference is the point. Not so long ago I actually contacted the founder of Hundred Stories, out of frustration with her account execs (nearly all of them I might add). I wonder if you can guess what Robin Dolch's (image below right) reaction was when I explained having been SPAMMED over and over again?`

She mailed me a hyped up release the very next day.

Now, you may think my methods here excessive, but I assure you I have thought about how to proceed many times. First off, I would hate for anyone to be so infringed upon. Sure, in the PR and marketing world mistakes happen. An editor at Forbes gets on his ear over an untimely instant message, a misunderstanding with some web celebrity arises, our perceptions even ' they can confuse us as to even reality sometimes. I know my ideas of 'who' people actually are have been askew at times.

Now, you may think my methods here excessive, but I assure you I have thought about how to proceed many times. First off, I would hate for anyone to be so infringed upon. Sure, in the PR and marketing world mistakes happen. An editor at Forbes gets on his ear over an untimely instant message, a misunderstanding with some web celebrity arises, our perceptions even ' they can confuse us as to even reality sometimes. I know my ideas of 'who' people actually are have been askew at times.

Repeatedly aggravating the very people who help your efforts? This is a sort of madness. Then looking at Twitter and instagrams (left) of the event, I cannot help but suggest replacing the Russian Standard with Danska if top drawer alcoholics ever attend real estate wingdings.

Several times I have reported about Hundred Stories client efforts. This one in the Catskills comes to mind first. I really liked what the developer was doing there. You see, I fed the PR monster. Yet she decided to literally bite the hand. Or, maybe it was an oversight! I paste below a portion of one of the mails I sent to Cassandra Carpio, now a director at Hundred Stories:

'Casandra,

Please remove both the emails of mine above from Hundred Stories PR's mailing lists. Just so you know, I get hammered sometimes by editors and writers just for sending a once in a while release. If any of my friends in media got three in one day from my people, they would blacklist me forever. And they're my pals'.'

There is more to the story, but I'll save it for a fresh instance of SPAM.

Let me leave off by saying this, tolerance is absolutely the best quality any human being can exhibit. Doing any kindness, then having your face slapped' Well, I know you understand. In the last 10 years writing online I developed a bit of a reputation as what some people call 'a loose cannon' ' it is well earned, I guess. I say what I think, which to me seems like another decent human quality ' it is after all truthful. I am reminded of a quote from Abraham Lincoln somehow:

'Character is like a tree and reputation like a shadow. The shadow is what we think of it; the tree is the real thing.'

The truth about 400 Fifth Avenue, commonly known as The Setai, is that the 631 foot tall skyscraper is 64th tallest building in New York City ' a bit like our tree up there, the character of which is pretty easy to see. It is also a rejuvenated landmark invigorated by some of the world's most talented developers and workers. The development is something readers will like to hear about, even if they cannot afford the $1.4 million it would cost to buy 779 square feet (PDF) of apartment. Elite Traveler listed The Setai as one of the top 101 suites in the world.

The truth about 400 Fifth Avenue, commonly known as The Setai, is that the 631 foot tall skyscraper is 64th tallest building in New York City ' a bit like our tree up there, the character of which is pretty easy to see. It is also a rejuvenated landmark invigorated by some of the world's most talented developers and workers. The development is something readers will like to hear about, even if they cannot afford the $1.4 million it would cost to buy 779 square feet (PDF) of apartment. Elite Traveler listed The Setai as one of the top 101 suites in the world.

As for the perception of such lofty places, shadows can shimmer and be misinterpreted, now can't they? An apology for an inexcusable breach of netiquette will tell the truth of a Manhattan PR company.

A sign of the times or not, the 121 years of Whitehead Inc. Realtors in Rockford, Illinois ending is just bad news. Owners of that areas biggest real estate firm, Dee and Stan Premo (at left), have notified their agents of the firm's closing next month.

A sign of the times or not, the 121 years of Whitehead Inc. Realtors in Rockford, Illinois ending is just bad news. Owners of that areas biggest real estate firm, Dee and Stan Premo (at left), have notified their agents of the firm's closing next month.

Having landlord and tenant portals, online payments, even a convenient magazine app for iPad, Foxton not taking advantage of the power their agency possesses is almost criminal. Our readers can download Area at iTunes here, but for a company that has led in many ways the London letting and even sale market, being so far behind technically seems ludicrous.

Having landlord and tenant portals, online payments, even a convenient magazine app for iPad, Foxton not taking advantage of the power their agency possesses is almost criminal. Our readers can download Area at iTunes here, but for a company that has led in many ways the London letting and even sale market, being so far behind technically seems ludicrous. For the first 20 years of it's existence the Federal Housing Administration, created in 1934, enjoyed a delinquency rate of 0.2%. As of September 2012, the delinquency rate has surged to a record 17.3%. Compare that to less than 2% for privately insured mortgage company, MGIC.

For the first 20 years of it's existence the Federal Housing Administration, created in 1934, enjoyed a delinquency rate of 0.2%. As of September 2012, the delinquency rate has surged to a record 17.3%. Compare that to less than 2% for privately insured mortgage company, MGIC.

Now, you may think my methods here excessive, but I assure you I have thought about how to proceed many times. First off, I would hate for anyone to be so infringed upon. Sure, in the PR and marketing world mistakes happen. An editor at Forbes gets on his ear over an untimely instant message, a misunderstanding with some web celebrity arises, our perceptions even ' they can confuse us as to even reality sometimes. I know my ideas of 'who' people actually are have been askew at times.

Now, you may think my methods here excessive, but I assure you I have thought about how to proceed many times. First off, I would hate for anyone to be so infringed upon. Sure, in the PR and marketing world mistakes happen. An editor at Forbes gets on his ear over an untimely instant message, a misunderstanding with some web celebrity arises, our perceptions even ' they can confuse us as to even reality sometimes. I know my ideas of 'who' people actually are have been askew at times. The truth about 400 Fifth Avenue, commonly known as The Setai, is that the 631 foot tall skyscraper is 64th tallest building in New York City ' a bit like our tree up there, the character of which is pretty easy to see. It is also a rejuvenated landmark invigorated by some of the world's most talented developers and workers. The development is something readers will like to hear about, even if they cannot afford the $1.4 million it would cost to buy 779 square feet (PDF) of apartment. Elite Traveler listed The Setai as one of the top 101 suites in the world.

The truth about 400 Fifth Avenue, commonly known as The Setai, is that the 631 foot tall skyscraper is 64th tallest building in New York City ' a bit like our tree up there, the character of which is pretty easy to see. It is also a rejuvenated landmark invigorated by some of the world's most talented developers and workers. The development is something readers will like to hear about, even if they cannot afford the $1.4 million it would cost to buy 779 square feet (PDF) of apartment. Elite Traveler listed The Setai as one of the top 101 suites in the world.

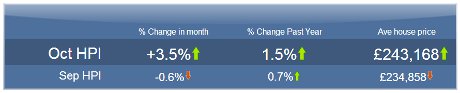

Statistics from Rightmove in the UK show home pricing up there. RightMove lists over 90 percent of all the homes for sale in the United Kingdom.

Statistics from Rightmove in the UK show home pricing up there. RightMove lists over 90 percent of all the homes for sale in the United Kingdom.

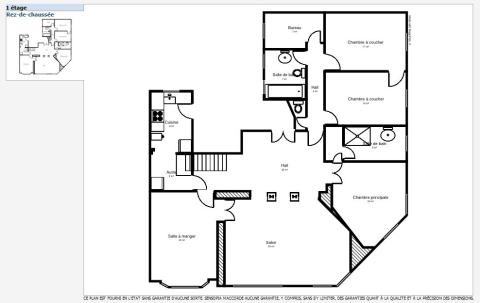

Have you ever had a home buyer request floor plans for a home or condo they're interesting in purchasing and you either don't have access to the plans or they simply don't exist? It seems to happen all the time to real estate agents in larger markets who specialize in high-rise condominiums or rentals. In buildings like Chicago's John Hancock Center, for example, nearly every floor has a different and unique layout due to its tapering figure, and many residential skyscrapers around the country fall into this exact same category.

Have you ever had a home buyer request floor plans for a home or condo they're interesting in purchasing and you either don't have access to the plans or they simply don't exist? It seems to happen all the time to real estate agents in larger markets who specialize in high-rise condominiums or rentals. In buildings like Chicago's John Hancock Center, for example, nearly every floor has a different and unique layout due to its tapering figure, and many residential skyscrapers around the country fall into this exact same category.