A story yesterday by CNBC's Diana Olick got my attention initially because of the title; 'Home Buyers Are Back, but Where Are the Houses?' In that article Olick talks about the Spring housing market, and about how house inventories are staggeringly low given all the variables. With the raw number of homes for sale its lowest in over a decade, the question 'Where are all the houses?' certainly is a curiosity. Let's take a look at some speculation.

Quoting Lawrence Yun, chief economist for the National Association of Realtors, on the subject:

'Some listings are vanishing from a strategic decision of waiting for an even a higher price later. Some are due to few newly built homes available to trade-up to, hence some current existing home owners are unwilling to list. Some could be related to fear of being unable to buy after selling.'

Shadow This, Shadow That, Shadow Inventories?

For his part Yun has been discussing the possibilities of a big housing shortage for some time now actually. In this article over at NAR, Yun further analyzes the situation with regard to affordability and the constrictions of limited supply. However, throughout expert analysis and the predictive matrix of market analysis (especially the articles cited) it's very clear no one has really tried to figure out exactly where house inventory is now, in whose hands America's so called 'shadow inventory' sits. Shadows, wait until you read to the end of this story.

Looking to an article at Forbes, more clues as to the house shortage appear in the form of investors who bought America's homes up in record numbers to turn a profit. While many news reports minimize the effect investors have had on the market, the $82.5 billion foreigners spent from 2011 to 2012 buying up properties in the US bears scrutiny. Any segment 'buying into' a market at a 24% share increase year on year ' moves like international buyer flocking to buy America deals help explain all market forces. And the international buyers are not just Chinese, in case you are thinking that way.

Let's depart from international pressures upon the market, while a sort of 'Rising Sun' situation does exist, it's not just Argentinians or Russians with lots of cash snapping up properties in the US. This article at Bloomberg Businessweek get's us closer to all those 'hidden houses' out there. In this piece Roben Farzad pits two philosophies of 'investment' in real estate against one another. First, Robert Shiller's 'Homes Are A Risky Long Term Investment (PDF) basically negates the idea of home ownership as any sort of profitable venture. And before you scoff at the idea, I suggest you read the paper. Second, Farzad brings in Andrew Jeffery, a director of acquisitions for Cirios, to basically debunk Shiller's stance. Jeffery does a nice job of twisting about the idea that somehow every homeowner is thinking about 'flipping' their home to double their investment. The big here is totally lost.

Shiller, and Jeffery for that matter, do allude to a more compelling answer to the 'shadow homes' sitting out there in no man's land. Speculators.

An idea not so many think about is just how manipulated (leveraged) any market in the world really is. When I speak of leverage or influenced in this sense, I really mean propagandized. Anyone out there considering investment of any kind needs to examine just what a speculator is, just what salesmen and marketers do, maybe even what a carnival grifter does. There's some 'shadows' out there all right, but the houses did not just vaporize into thin air.

Only the Shadowy Investment Figure Knows

A snapshot look at two investment giants, Stephen Schwarzman's Blackstone Group and Billionaire B. Wayne Hughes, reveals big time players playing all ends against the middle, so to speak. These two multi-billion dollar entities have bought tens of thousands of homes since the bubble burst to take advantage of the economic situation. Evil geniuses or not, opportunities, buying low and selling high, and other such cliches apply. Hughes' American Homes 4 Rent, it could be said, slaps less fortunate America straight in the face. Form a layman's standpoint, these striped suited demons would kill Flipper for a tuna sandwich.

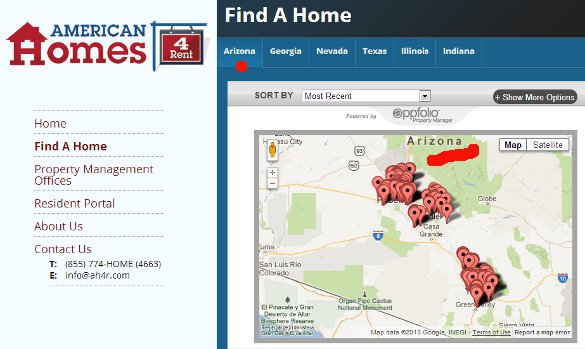

American Homes 4 Rent showing a vast Arizona inventory

Looking back at the CNBC article up there, where's the fist place Diana Olick mentions a shortage of homes is problematic? Interestingly, Arizona is first on her list as well as withing the search mechanism for Hughes' American Homes 4 Rent. That's right, where one demand is, another speculator is also. Of course there's no law against entrepreneur's seeking out and finding the American Business Dream, but the term 'cleaning up' needs to find a way in here someplace. This house (home A) in Tuscon, for instance, is right down the street from a bigger house in the neighborhood that just sold for $168,000. Now, the mortgage on the bigger home is $595 a month. The rent on home A is $1,150 a month ' now as a reader you should be getting a feeling for what's going on in the big picture. Too vague here, I'll continue.

According to the 'news' American Homes 4 Rent 'expects' to see a 6 to 7 percent return on their rents. Of course the double rent per mortgage number jumps out, but the cynic out there can take heart in the fact depreciation, taxes, upkeep, administration, and a hundred other write-offs will have dwindled this figure down to just over $630.70 by the time the accountants are done. But this is not the most onerous idea the average American homeowner can get. Watch the video below featuring John Gray, head of Blackstone's National Single-Family Rental Home Platform.

In the video, not only does Blackstone try and convince the viewer that somehow buying people's lives is good, but Gray actually admits the real truth of my story ' these investors (speculators) are 'betting' home prices will climb. Their 'investors' are what is important, almost criminally important if you just were foreclosed upon.

This article at New Republic goes farther in telling of Blackstone's intended path where American homes are concerned. According to David Dayen's story, the world's largest player in the single family rental space will buy $100 million in distressed properties 'per week', and $1 billion in hard hit Tampa Bay alone. As for the international investors out there buying up America? Compared with the same American hedge funds that caused the housing crash in the first place, Russian billionaires and Chinese money bags are modest investors. In Oakland, California over 40 percent of all the foreclosed homes sold go to such investors.

Too Much Information? Too Bad, Read On

In case you are off balance a little bit at these revelation, let me drive home the point a little better here. To make this situation even worse, Fannie Mae and Freddie Mac actually make things easier for institutional investors to rent you your next home. This report goes so far as to suggest the government is 'protecting' you by not telling you where hedge funds bought up distressed homes in Phoenix of all places. Remember the Arizona 'shadow market'? Maybe now we understand how come supply is so short?

If a group of investors out there were buying up any hope most Americans would ever have of home ownership, and ultimately even benefiting further from the misery of hopelessness, would hanging be too good? My southern heritage shines through here a bit as my Mom always uses to refer to hooligans as 'not worth killing' and so forth. Since we have focused on Blackstone a bit in this article, it should come as no surprise to learn that firm's partner Riverstone Residential hooked up with credit reporting bureau Experian in order to create a national database of tenant payment histories. This kind of thinking, in the end, tells of one missed payment damning a tenants chances to ever get into ownership. If my surmise is true here'

If a group of investors out there were buying up any hope most Americans would ever have of home ownership, and ultimately even benefiting further from the misery of hopelessness, would hanging be too good? My southern heritage shines through here a bit as my Mom always uses to refer to hooligans as 'not worth killing' and so forth. Since we have focused on Blackstone a bit in this article, it should come as no surprise to learn that firm's partner Riverstone Residential hooked up with credit reporting bureau Experian in order to create a national database of tenant payment histories. This kind of thinking, in the end, tells of one missed payment damning a tenants chances to ever get into ownership. If my surmise is true here'

The New Republic report up there comes right out and suggests this whole housing recovery/shortage/market itself is not artificial! As it turns out David Nayen already wrote my story for me. Well almost. What Nayen did not just some out and say is how a very few people in and out of America, have pretty much snuffed out any chance most people will ever have at prosperity of any kind. Worse still, the 'idea' of an American Dream of any sort is about as dead as a door nail (more southern charm coming out).

You, my dear reader, do not have to be Einstein to discover exactly where American prosperity headed off to. During the worst economic upheaval since the Great Depression, one segment of the US economy has thrived. Wall Street and the investment bankers. Period. That neighbor of yours, the one whose kids played with your kids til they had to move off? Those people got slung back into the age old melting pot of hopelessness folks. Now multiply your neighbor times several million! From legendary hedger George Soros (left) to Blackstone's Schwarzman (above right), B. Wayne Hughes, names like Hank Paulson, Kathleen Ann Corbet, and especially former Senator Phil Gramm, the filthy rich and other instrumental people in the investment world wreak of at best profiteering. At least in my view. Just look at how Soros Fund Management has profited from the acquisition of IndyMac Bank and part of the $160 billion in assets there.

Gramm, who is considered along with Alan Greenspan to be one of the two most responsible for the Great Recession (former President Bill Clinton is in there someplace), has been a Vice Chairman of UBS AG since he left the Senate. UBS's most recent notoriety came with allegations of the Swiss bank helping US tax evaders, and the so-called 'Rogue Trader Scandal', but the firm's history is resplendent with almost notorious under-dealings. Not only was the bank way over-exposed to the sub-prime market Gramm helped to create, it was discovered at length that the bank had probably had extensive dealings with the Nazis during WWII. Talking about Nazism and the unmitigated audacity of the ultra rich, take a look at the video below from The Ed Show.

The settlement of a In 1997, the World Jewish Congress lawsuit against Swiss banks (WJC) was launched to retrieve deposits made by victims of Nazi persecution during and prior to World War II, ultimately resulting in a settlement of $1.25 billion dollar lawsuit brought by the World Jewish Congress lawsuit against Swiss banks (WJC) in August 1998, was a much publicized event, a bit of bank legacy that is still frowned upon. As for Gramm, about all anyone has to remember about him comes from his statement about the mortgage situation when he was a Senator evangelizing the very rules that caused the Great Recession:

'Some people look at sub-prime lending and see evil. I look at sub-prime lending and I see the American dream in action.'

Homelessness residing right alongside affluence ' courtesy © elavuk81 ' Fotolia.com

A Real Never Ending Story

As you are probably beginning to fathom, this story literally has no ending. For the average person fathoming all this information, even the sheer sums of money we are talking about, it must be absolutely impossible. But we must try. Gramm's statement up there should sound familiar to you.

The idea of an American Dream involves the family home, or even a single person's home and investment therein. The concept has been used against us all along. Now, even within a system of economics that is absolutely failing, the same investment atmosphere that allowed for the biggest ripoff in history prevails. That's right, I just called the Great Recession a ripoff. You see, one has to look at what has taken place as a circular model. By this I mean simply that the whole housing bust was probably by a sort of design. How else could companies perform what amounts to a cyclical recycling of property? Inflate the market price, hit the owners at both the investment and taxpayer end of things (bailouts), the snatch up all the properties ' milk the assets, re-escalate, resell, and over again and again. This is why I alluded to 'penalties' not being stiff enough. Some actuary or team of actuaries has already calculated the risk of penalties/the gains in assets overall.

But we have to stop for now. I suggest, for a little more insight into how the American Dream is rigged so that a few can win it, study what 'socialization of loss' and other terms mean via articles like this one at Time. As for the news you read concerning supply and demand housing markets, please consider buying low and selling high again. Big investment types own newspapers too, you know? Remember the rumor of home-ownership before 2007, that even with horrible credit 'you too can be a homeowner?' It appears the penalties against Wall Street manipulations were not severe enough.

Here we go again.

Visit NBCNews.com for breaking news, world news, and news about the economy

0 komentar:

Posting Komentar