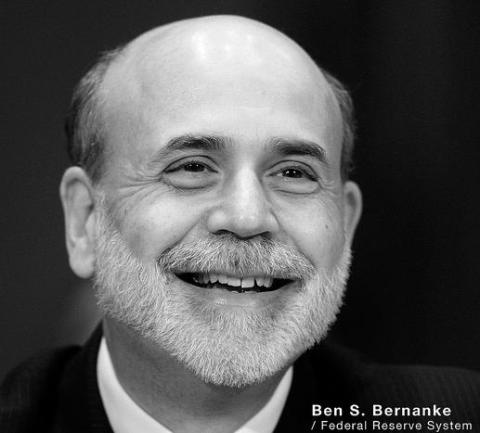

It's getting pretty obvious to anyone who is paying attention, that Fed Chairman Ben Bernanke believes he must do something about the fiscal cliff. He's just announced plans to create and spend $85 BILLION PER MONTH on mortgage and treasury securities ' that amounts to more than 1 TRILLION dollars over 12 months!

Image by Ondrej Kloucek via Flickr.com

That ought to be enough to just buy the fiscal cliff, put a fence around the edges, and turn it into a public park. It won't get rid of the cliff, but we will be able to get close enough to actually see the bottom and marvel at how big and deep it looks in person.

For the average individual, this plan is pretty much the same as taking out multiple credit cards, using them to pay your bills and calling it prosperity. Never mind that this whole mind boggling process is destroying the purchasing power and incomes of ordinary americans, causing food and household prices to rise, and there is absolutely no oversight or approval from the congress or any other governmental authority.

A policy of open ended QE3 and now essentially a 'QE4' for treasuries, is raising plenty of concern from folks who really understand what kind of economic problems this program could, and probably will lead to.

Here are Rob Chrisman's comments, as taken from his piece on Mortgage News Daily: (bold type added for emphasis)

'The Fed caught the market's attention yesterday,'and we are reminded that one branch of the government is issuing securities while another branch is buying them. What's wrong with this picture? The Federal Reserve said it will buy $45 billion a month of Treasury securities starting in January, 'The buying announced today will be in addition to $40 billion a month of mortgage-debt purchases (don't forget that the $40 billion is over and above prepay reinvestments)'

'Success consists of going from failure to failure without loss of enthusiasm.'' 'In many areas housing is mostly improving based on the Fed purchasing Freddie and Fannie (and some Ginnie) MBS. What happens when it stops?''When the Fed stops buying securities, the laws of supply and demand dictate that prices will drop and rates will go up ' plain and simple.'

No worries, we'll just turn the cliff into a park! © freshidea ' Fotolia.com

Richmond Federal Reserve President Jeffrey Lacker has gone public with his belief that Bernanke is interfering in fiscal policy.

Finally, Dallas Federal Reserve President Richard Fisher has compared the Fed's actions to a famous Eagles song, saying that this buying program may be tougher to get out of than 'Hotel California'.

Bernanke is planning a fiscal cliff 'overlook' sort of like they have at the edge of the grand canyon. Only this park will have a stunning view of an enormous canyon of debt with a river of dollars flowing at the bottom, digging it deeper and deeper. Oh, and there will be donkeys you can ride all the way to the bottom.

Donna S. Robinson is a real estate investor, author and residential investment analyst. Follow her on twitter at donnaconsults. Her latest book, Basics Of Real Estate Investing is now available on Amazon.

0 komentar:

Posting Komentar