In news from China's real estate sector, SouFun Holdings Limited reported earlier this week establishing their Shanghai headquarters in support of expansion plans there. In conjunction with this news, the leading Internet portal for the industry there also announced acquiring a portion of the BaoAn Building in Shanghai for the offices. The terms of the deal included a $127 million cash payment according to their press.

Courtesy © Subbotina Anna ' Fotolia.com

Vincent Mo, SouFun's Executive Chairman. also offered comment:

'Shanghai and East China area houses China's most active economic zones and has been contributing substantially to SouFun's growth. We have been testing our operations in Shanghai and East China area for the past year and the official establishment of our Shanghai Headquarters will definitely boost our operations in that area. The office space acquisition for our Shanghai Headquarters shows SouFun's commitment to Shanghai and East China area and will support Shanghai Headquarters' ever increasing need for office space.'

Meanwhile, Bloomberg reported this morning China home prices having risen for seven consecutive months on what the financial experts there term 'recovery' for a sagging market. According to the National Bureau of Statistics last month, prices were up in 53 of 70 major cities across China in November.

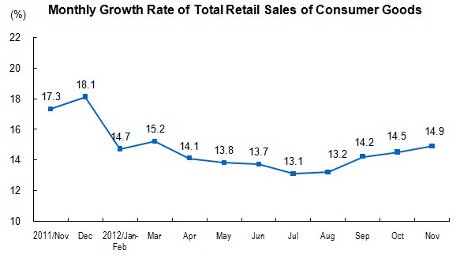

While real estate investment growth is still down compared with 2011 figures, the trends upward can easily be seen in data provided by NBS. In fact, the upward trend corresponds almost exactly with the growth in consumer retail purchases shown in the chart below.

Growth rate retail sales ' courtesy National Bureau of Statistics

When combined with statistics on other upward trends, the news definitely reflects upward momentum for China where the recession is concerned. Even though reports suggest the service industry in China has slowed, industrial profits are definitely on an upward trend. In support of this apparent trend, private equity giant Blackstone Group LP announced starting a new real estate fund focused on Asia. That fund, reported at $13.3 billion, is the largest ever by the New York based investment firm launched by Stephen Schwarzman and Peter Peterson in 1985.

0 komentar:

Posting Komentar