Just when you thought it was safe to go back into the housing market. I've seen numerous articles in the media on how well the housing market is picking up. Many 'experts' are predicting that 2013 will be the year that a housing recovery finally picks up steam. But The St. Louis Federal Reserve Bank has some interesting housing data of their own.

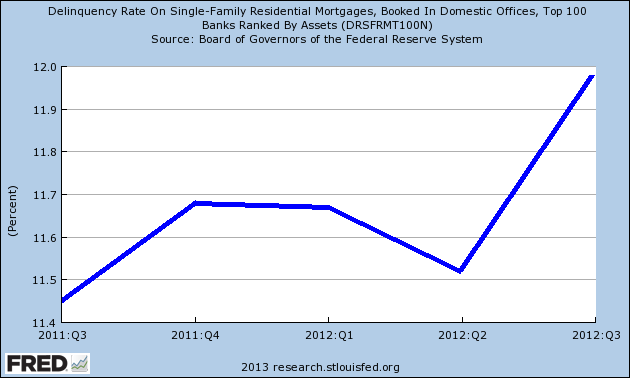

Turns out that mortgage delinquencies among the top 100 banks are almost at 12% of all mortgages held by the top 100 banks. As illustrated in the chart below:

Mortgage Delinquencies up significantly in 2012.

The chart shows graphically that delinquencies have been rising consistently over the last half of 2012, but the specific numbers included in the data set reveal some very interesting facts that are fundamental to the health of the housing market and any hope of a true recovery.

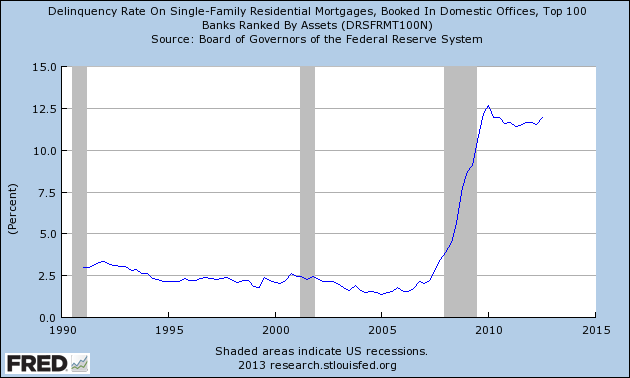

The data set goes back to January 1st, 1991. You may recall if you've been in the real estate industry for a while, that 1991 wasn't exactly a rosy year either. The real estate market had just weathered it's first major storm since the great depression. Interest rates were still hovering in the 9% range. We'd had a recession then too.

On January 1, 1991, the delinquency rate was a whopping 2.98%. By January of 1992, it had 'peaked' at 3.32% before it finally began to go down and stay down. By April of 2003, it was well below 2% and stayed there until it finally broke above 4% for the first time, in January of 2008. It had only been climbing incrementally for the four previous quarters.

As 2008 went on, delinquencies finally reached 7.76% in the last quarter of 2008. When the Obama administration took office in 2009, the delinquency rate was 8.73 percent. An all time high at the time. After reaching a new all time high of 12.66% in 2010, delinquencies fell back to a 'low' of 11.66% in 2011. They are at 11.98% as of the third quarter of 2012. This is the latest figure available as of this writing.

As for what kind of numbers this translates into, if my research is correct, we are talking about approximately 30 million mortgages. 12% of 30 million equates to about 3,600,000 borrowers in danger of foreclosure at the present time.

The chart below shows in graphic detail how far from normal the housing market really is:

Historical View Of Delinquency Rates Since 1991.

This can hardly be called a recovery, when you consider where 'normal' once was. A continuation of a delinquency rate that is more than five times the historical average, after 4 years, indicates that we do have systemic problems in the greater economy. And these numbers do NOT include those of the FHA, whose own delinquency rate was 16.48% as of December 2012, according to the American Enterprise Institute. Housing itself cannot drive a housing market recovery. Job growth and increasing earnings are big factors.

These fundamentals will continue to work to the favor of real estate investors and buyers with cash. Investors will continue to find a steady stream of foreclosures and shadow inventory out there. There is a shift underway, in favor of renting over buying, and a lower household formation rate will continue for the time being. 'Recovery' is probably not the right word. 'Transition' might be the appropriate word to describe what is happening. It's not your father's housing market anymore.

0 komentar:

Posting Komentar